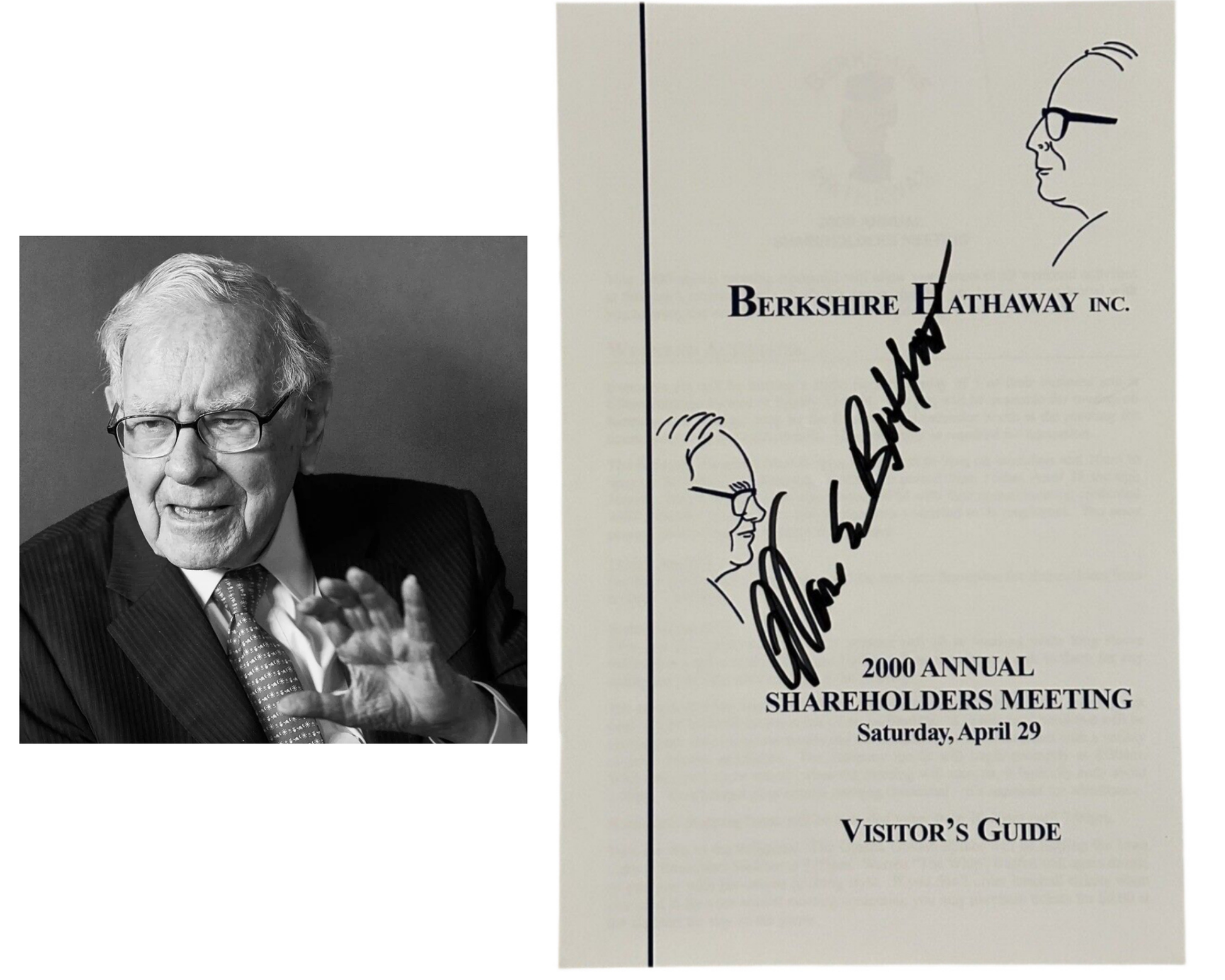

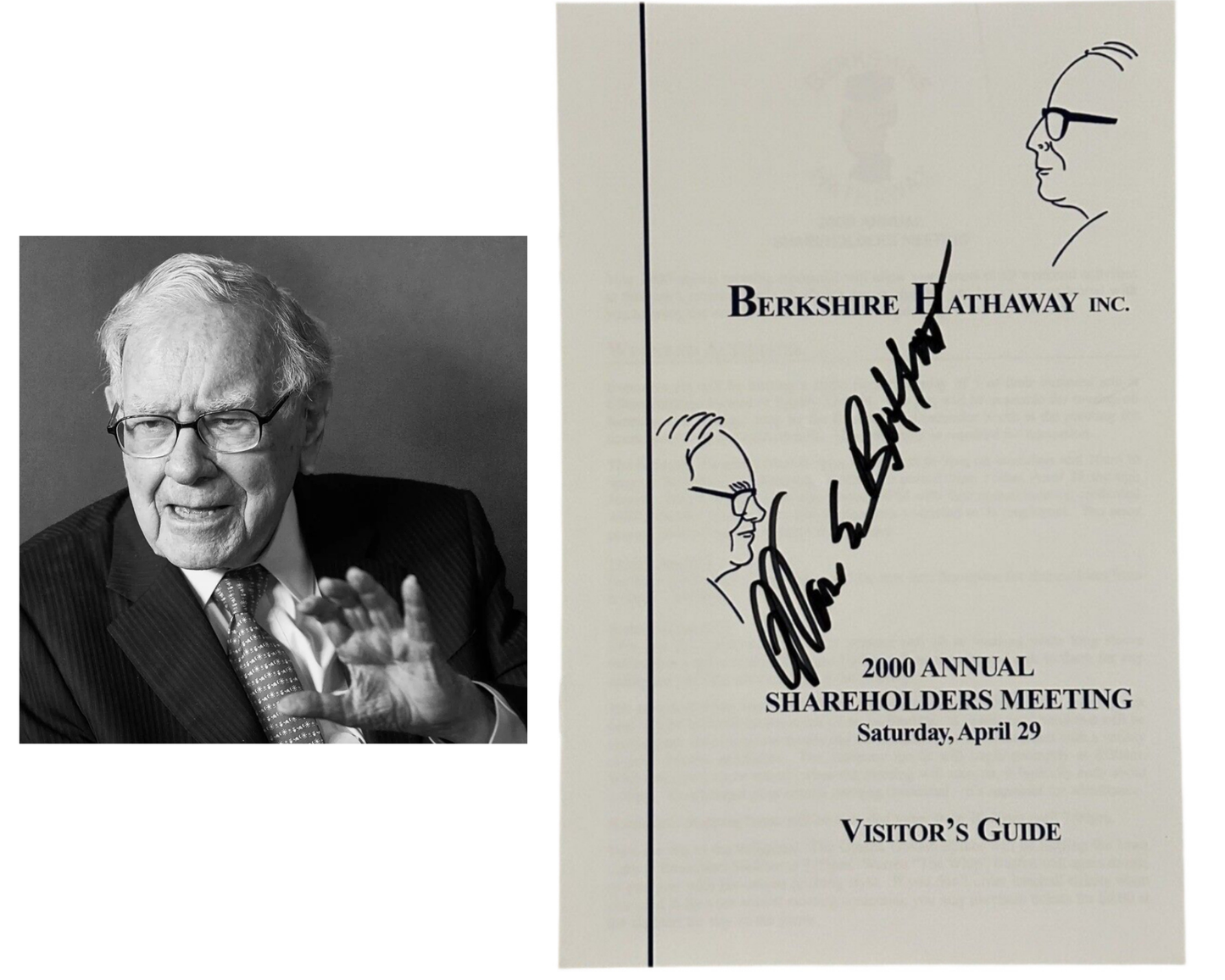

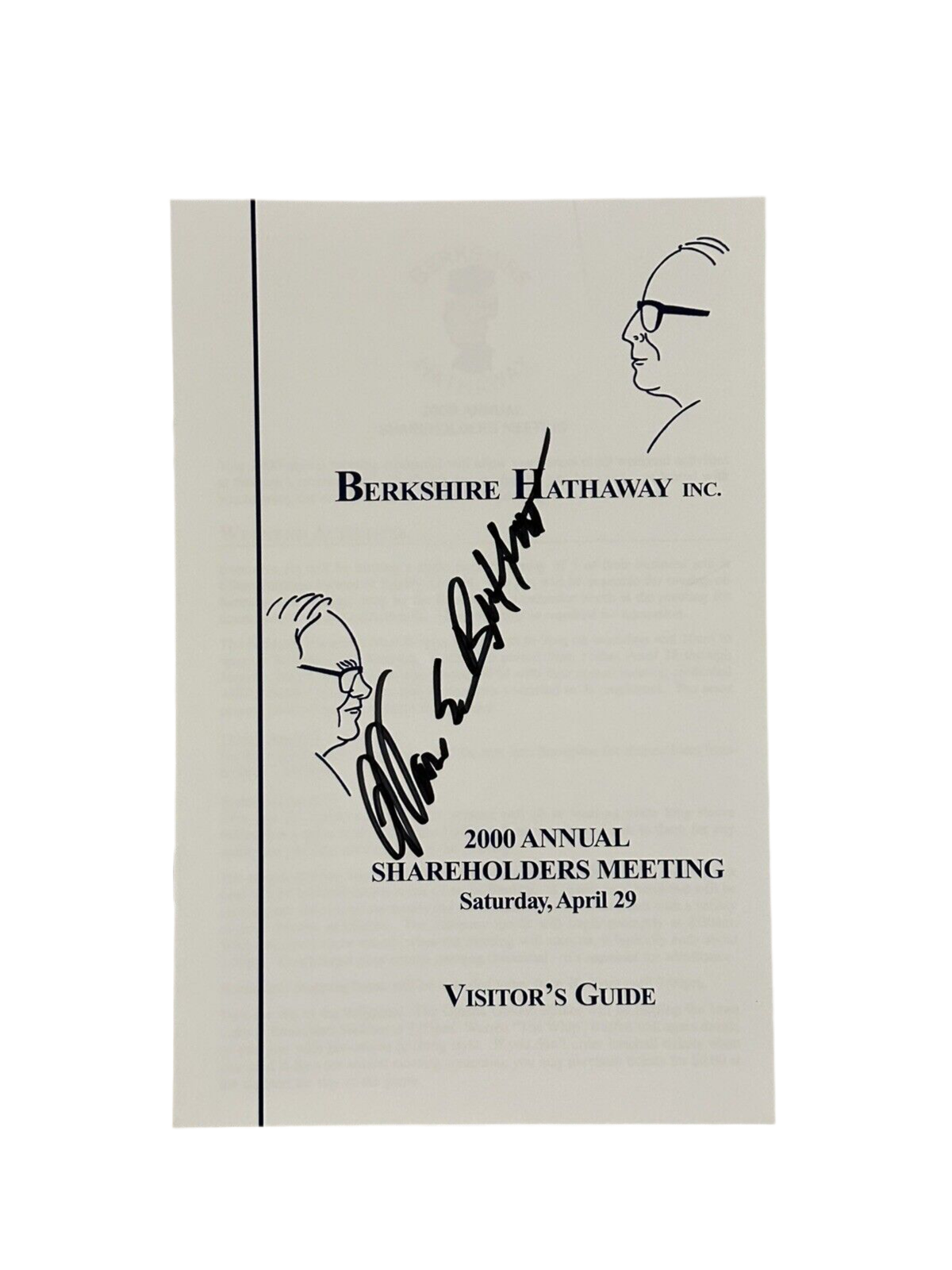

Warren Buffett Signed Berkshire Hathaway Annual Meeting Guide JSA Graded 10 Auto

Warren Buffett Signed Berkshire Hathaway Annual Meeting Guide JSA Graded 10 Auto

Couldn't load pickup availability

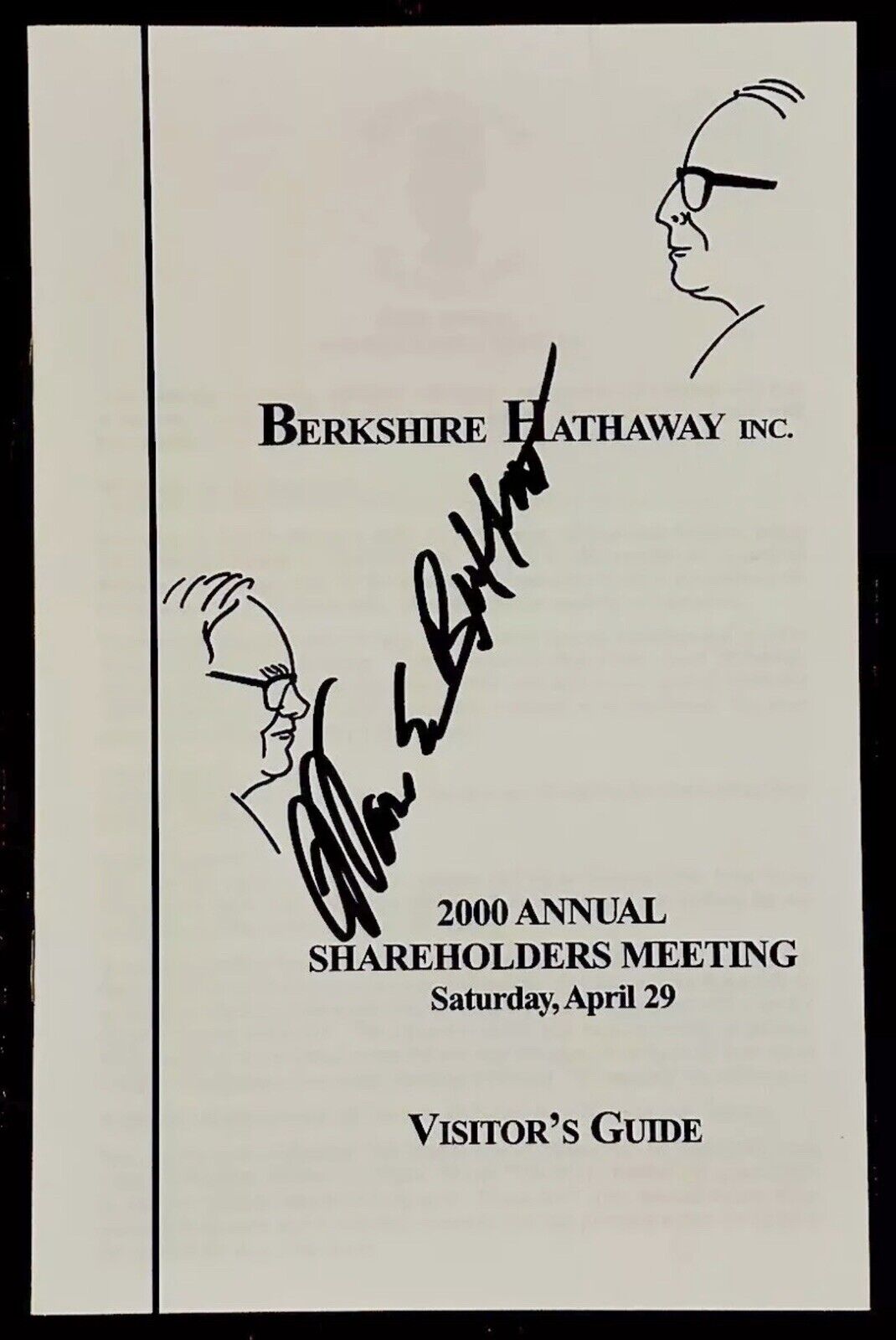

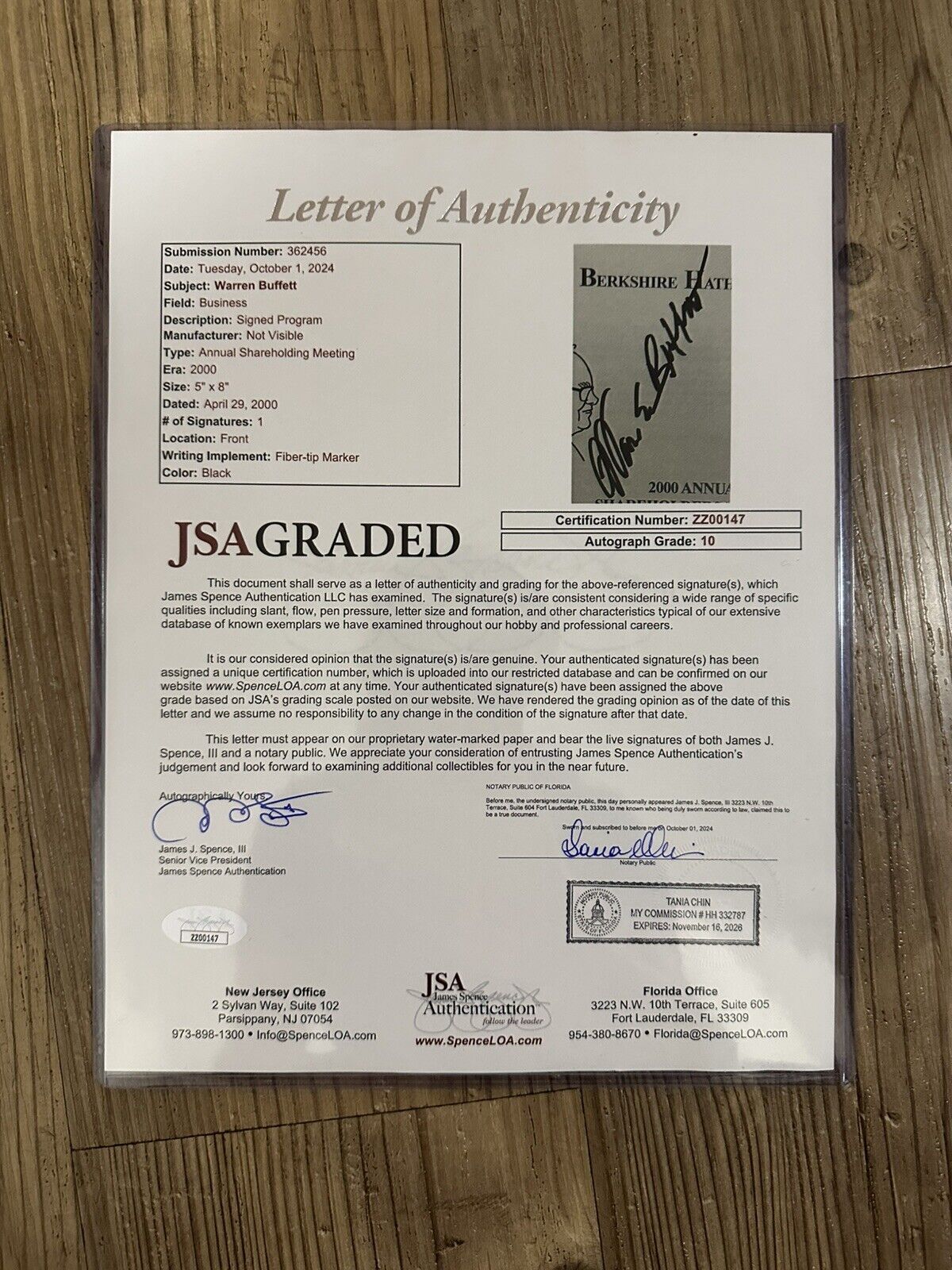

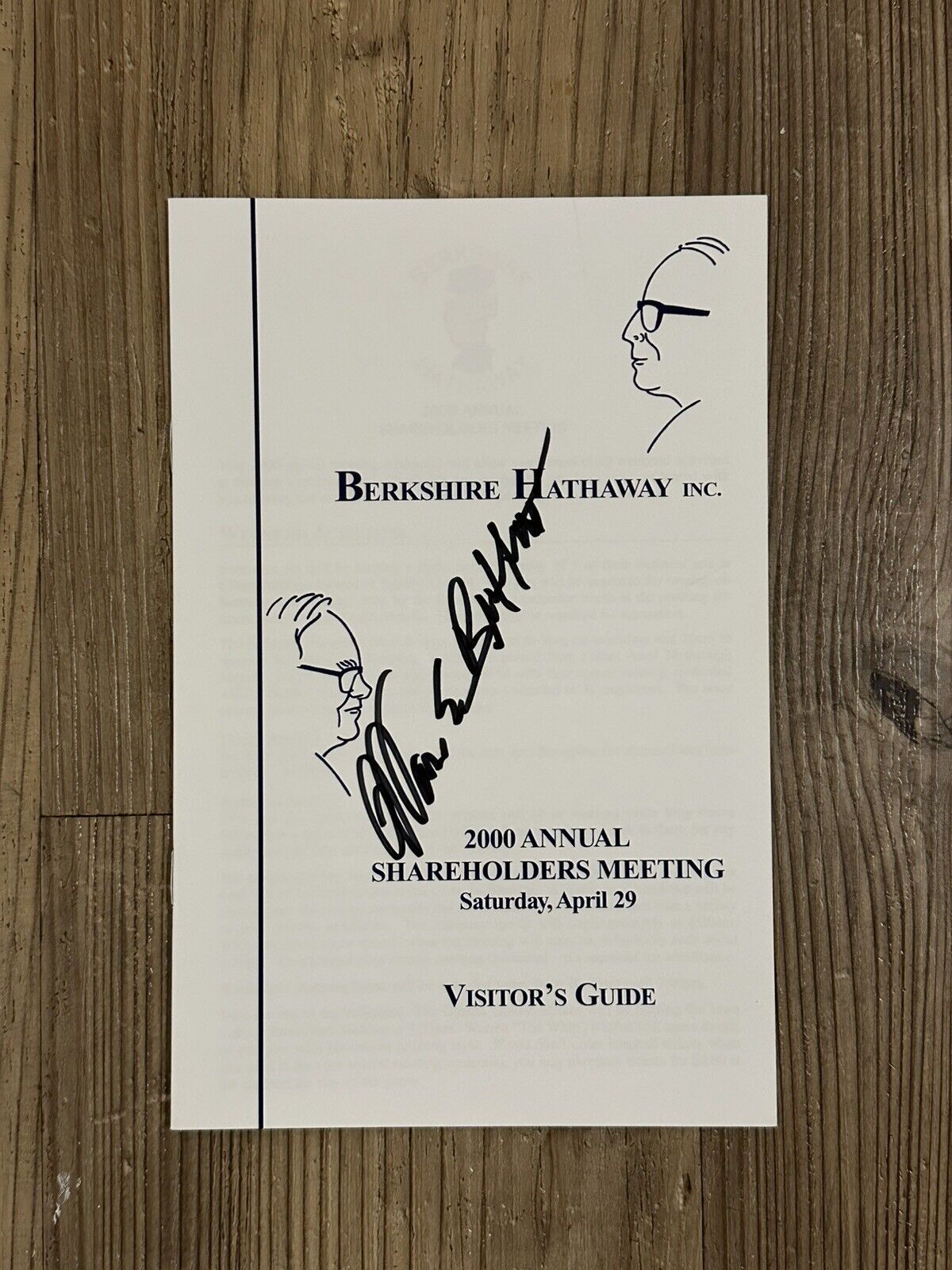

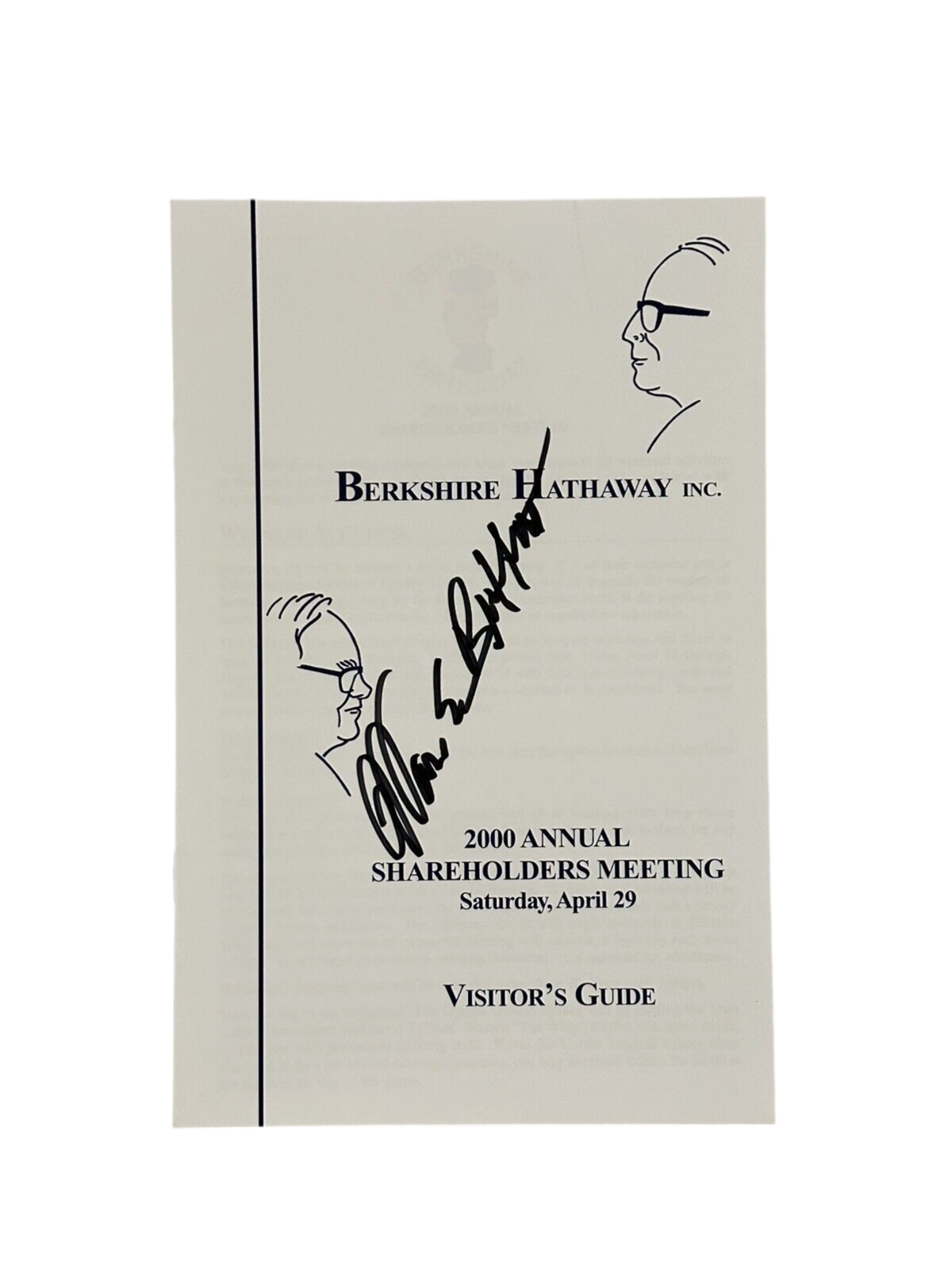

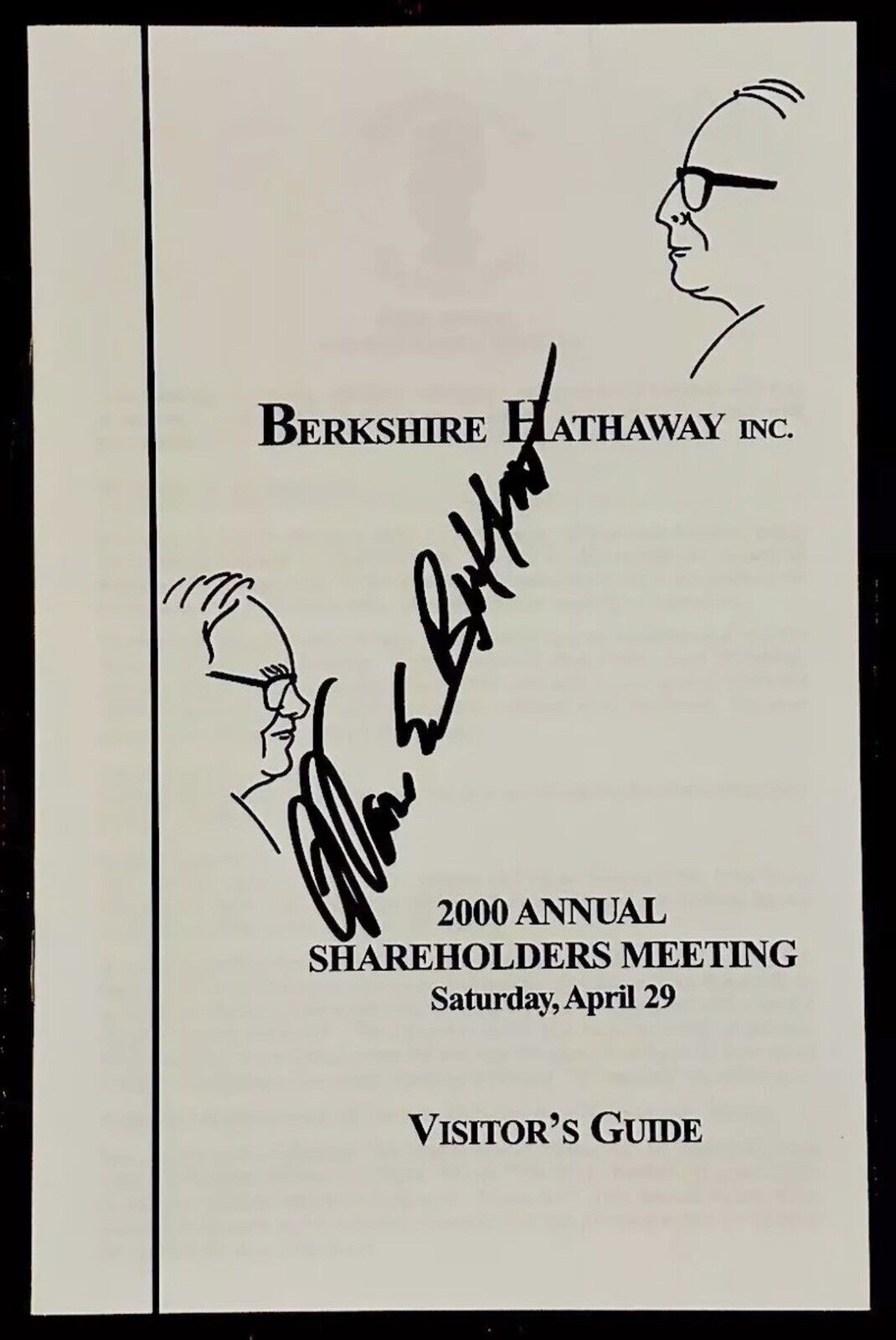

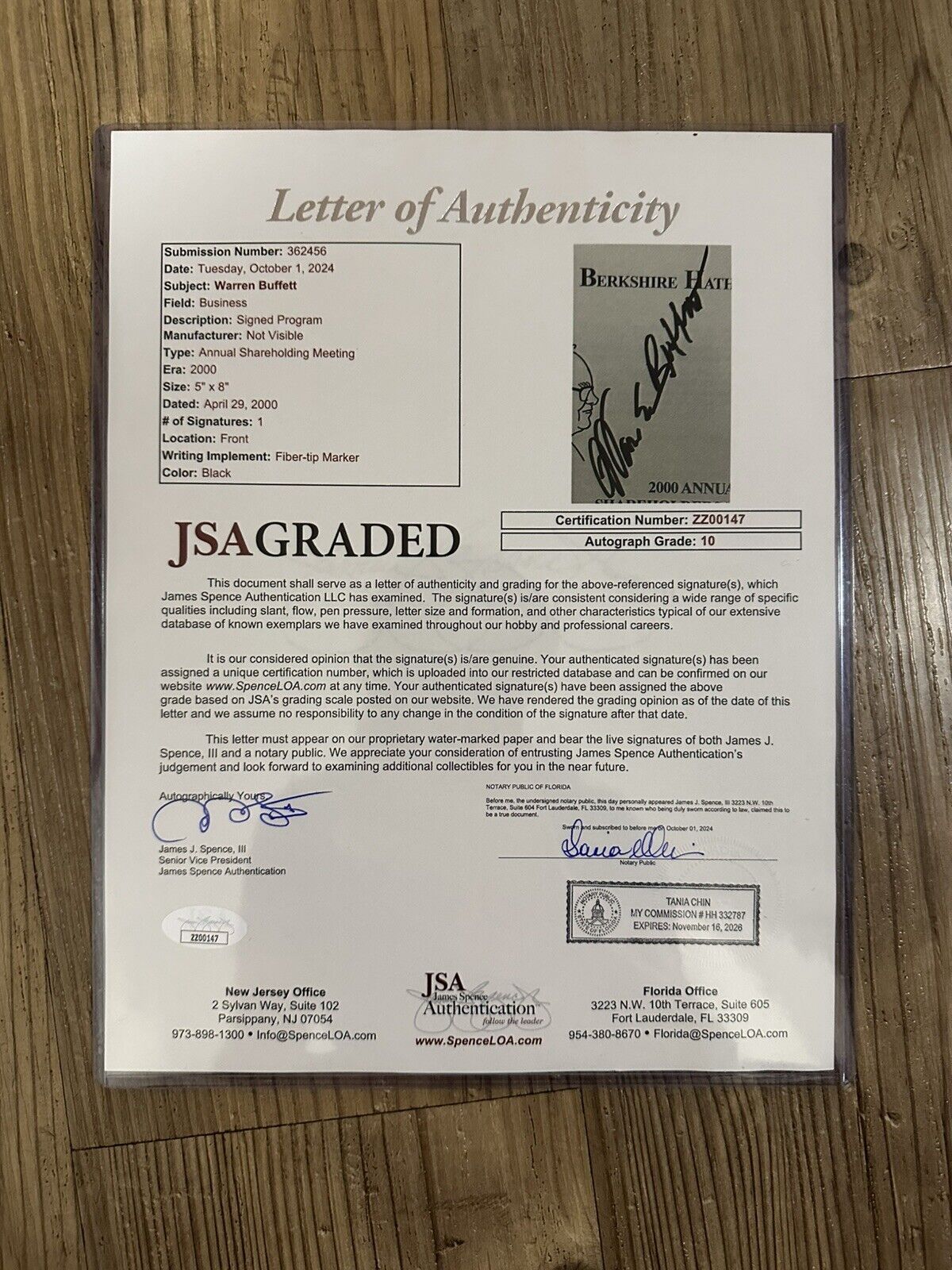

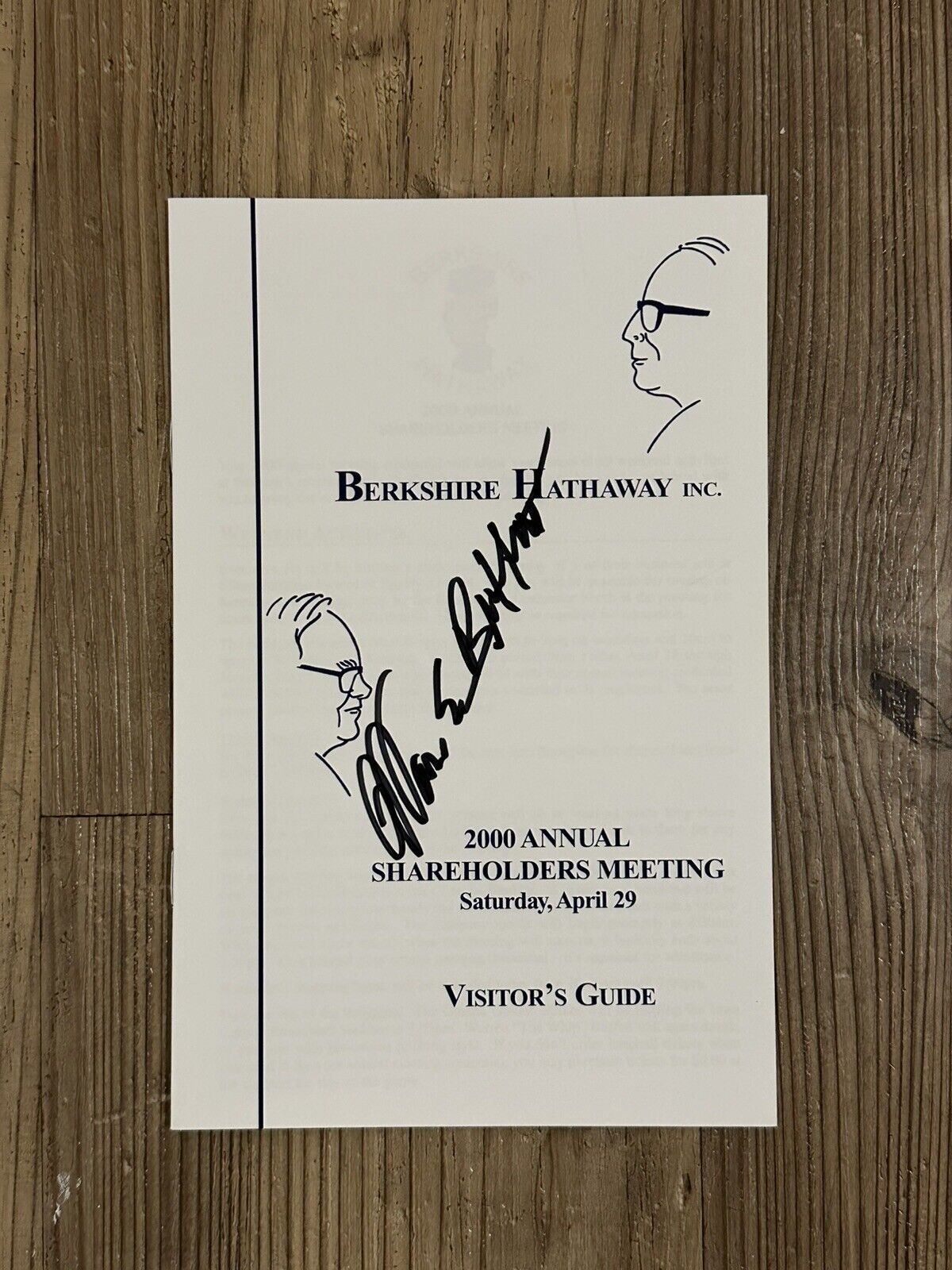

This is a signed visitor’s guide from the 2000 Annual Berkshire Hathaway Shareholders Meeting, held on Saturday, April 29th. The guide prominently features a bold signature of Warren Buffett, the renowned investor and CEO of Berkshire Hathaway. This signature has been authenticated by JSA (James Spence Authentication), one of the leading authentication companies in the industry, and has received a perfect grading of 10, indicating the pristine quality of the autograph.

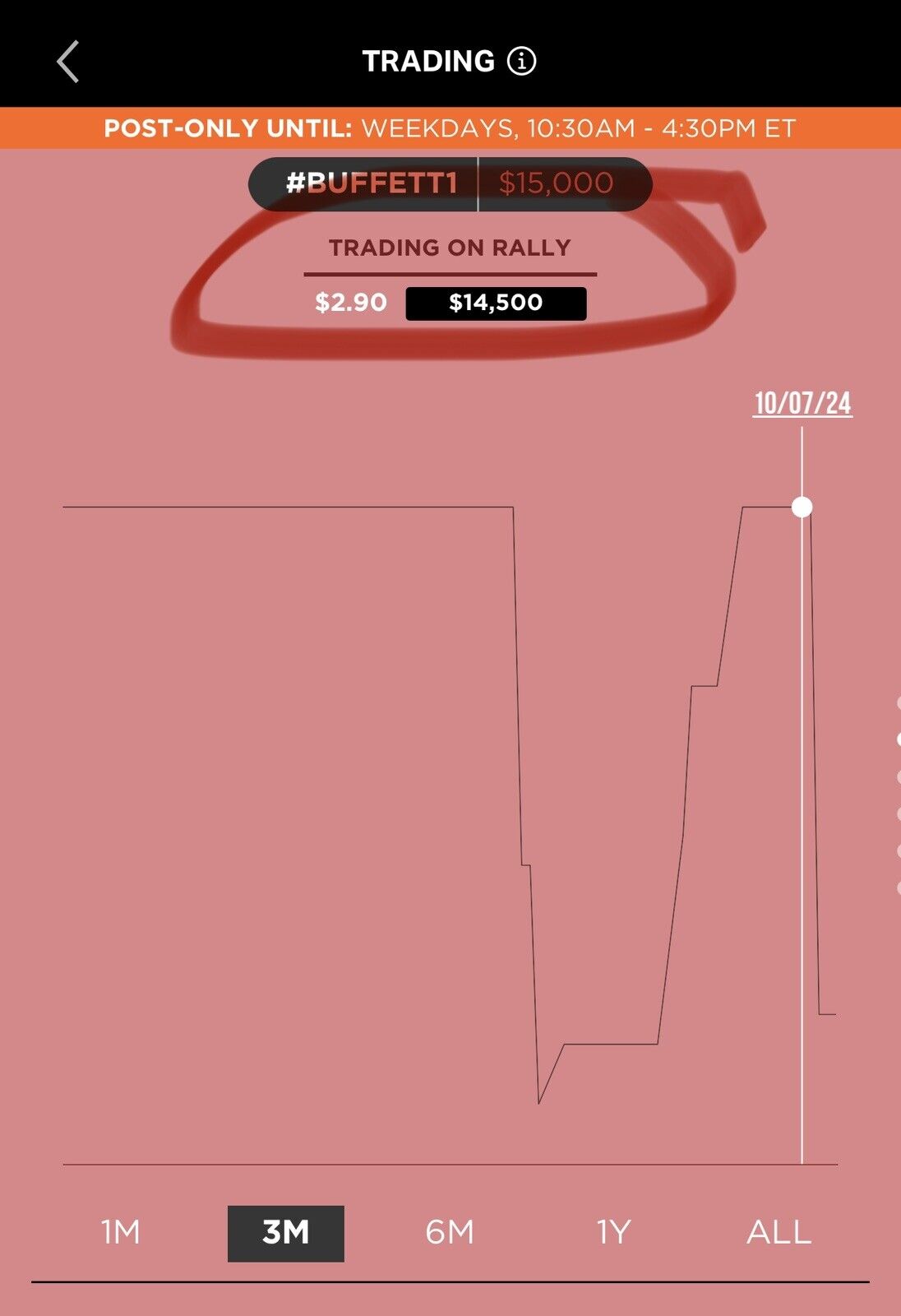

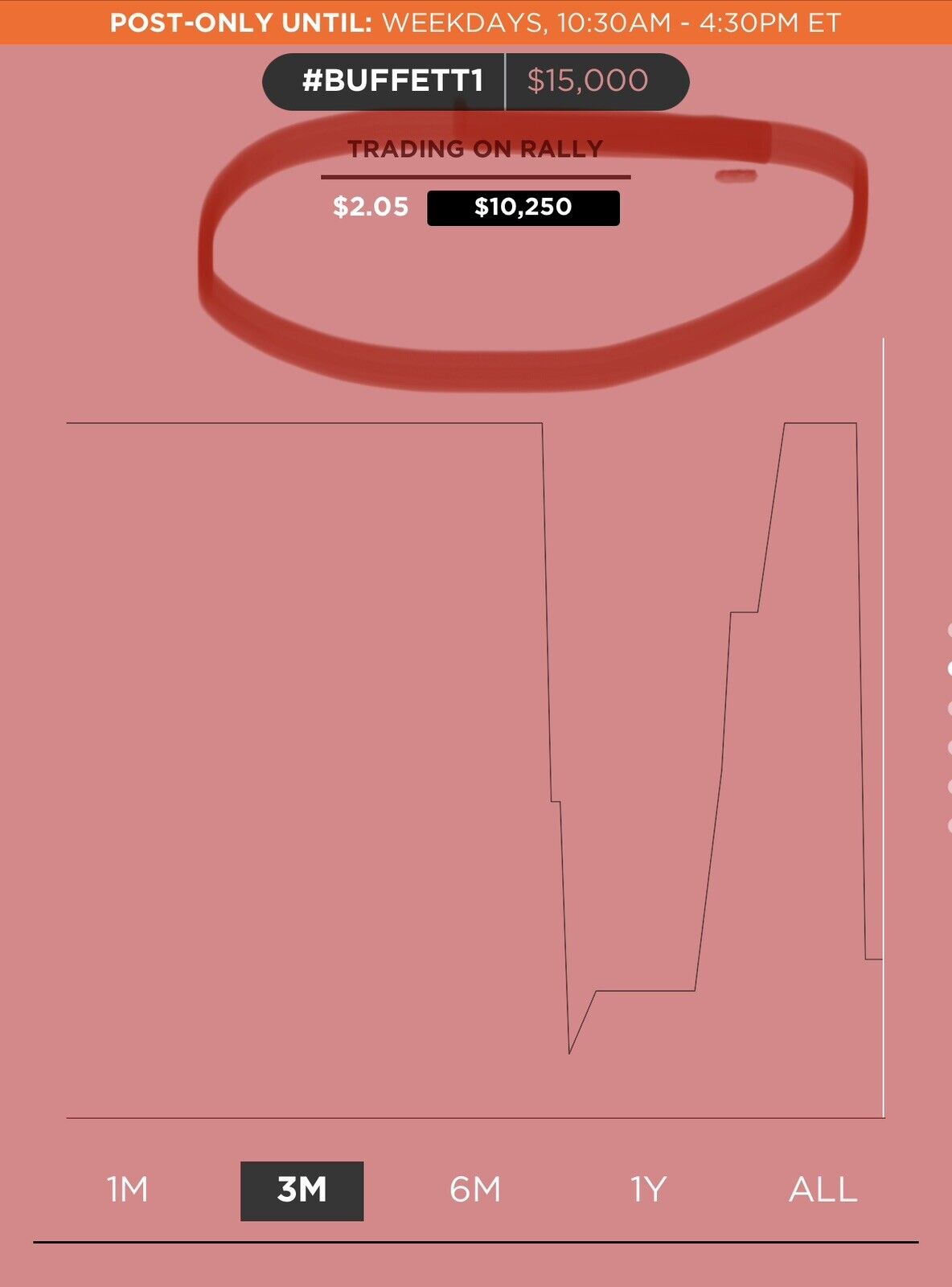

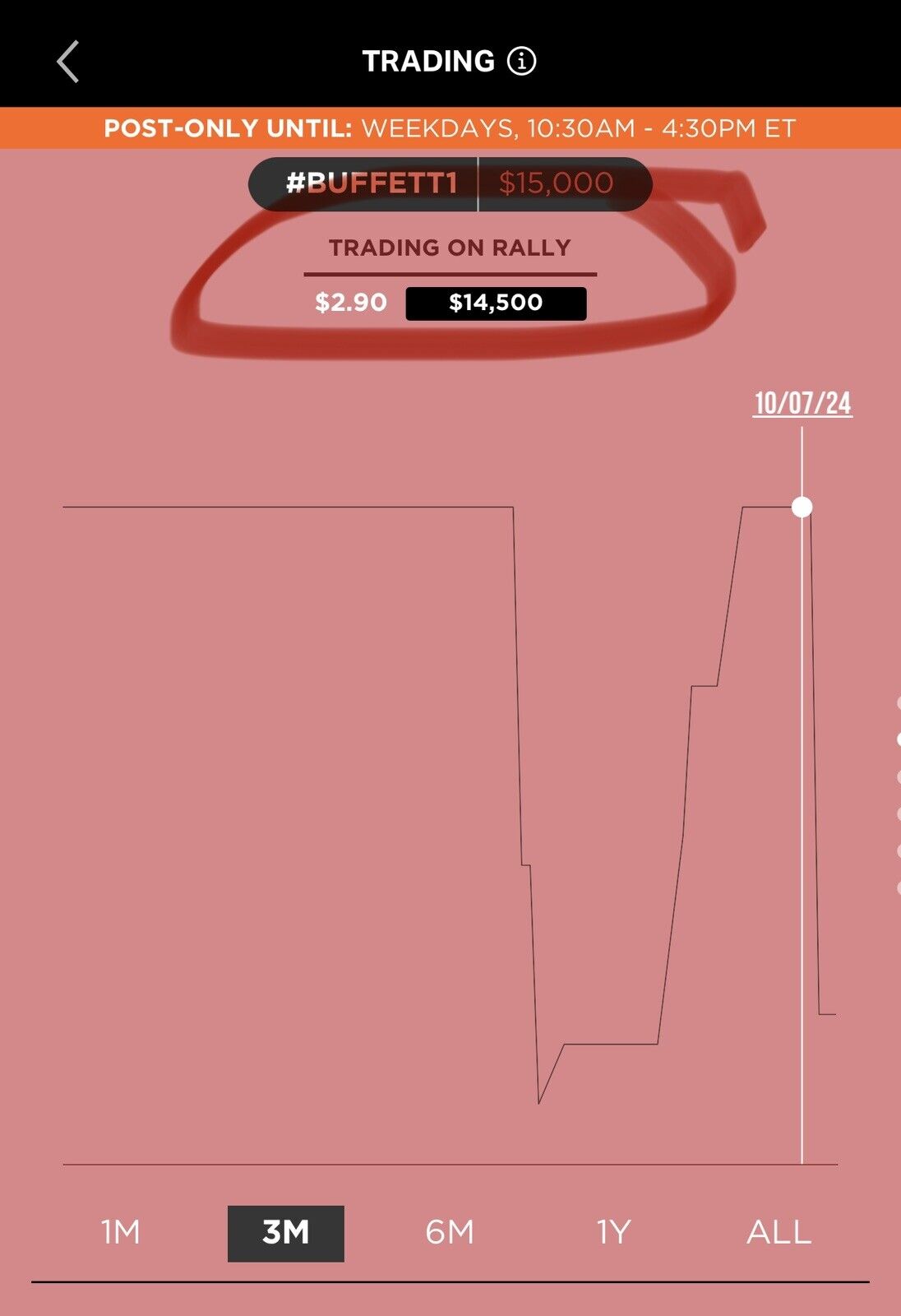

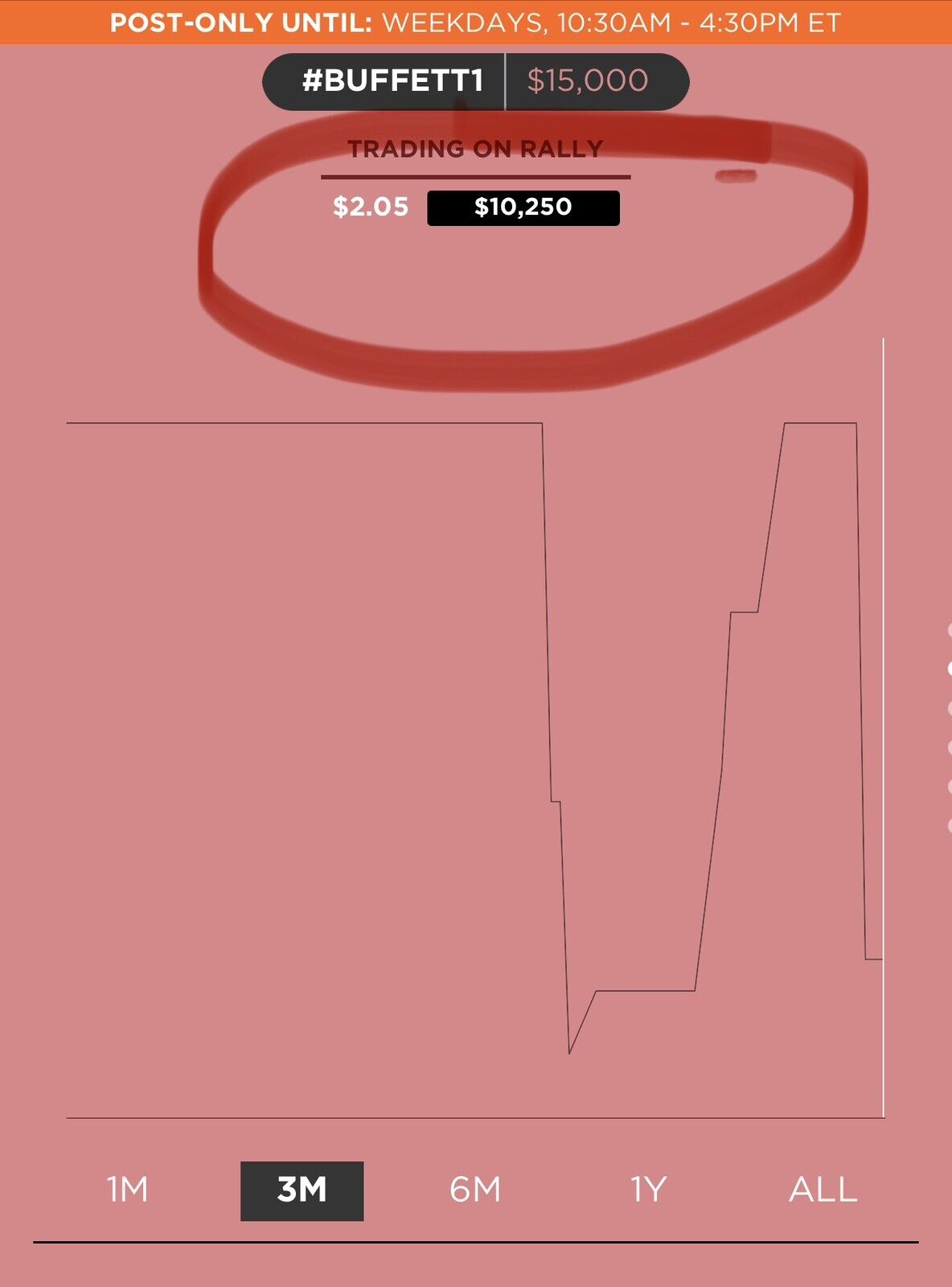

Additionally, an identical piece, likely signed during the same event, is currently being traded on the RallyRd app, a platform known for fractional ownership of high-value collectibles. The current asset value for the comparable signed guide is over $10,000, though at one point, it traded for as high as $15,000, highlighting the increasing desirability and value of Warren Buffett’s autographed memorabilia. A screenshot of the traded asset is included above.

Warren Buffett, often referred to as the “Oracle of Omaha,” is one of the most successful and influential investors in history. Born in 1930, Buffett began his investing career at a young age and has since become the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company. Over the course of his career, Buffett has amassed one of the largest personal fortunes in the world, primarily through value investing—a strategy that focuses on buying undervalued companies with strong fundamentals and holding them for the long term. His disciplined approach, patience, and ability to identify undervalued opportunities have made him a legend in the financial world.

Buffett’s contributions to the world of investing extend far beyond his personal success. He has popularized key investment principles such as “buying and holding” quality companies and the importance of long-term thinking. His annual letters to Berkshire Hathaway shareholders are studied by investors worldwide for their insights into markets, business strategy, and ethical investing. His influence on both the financial industry and philanthropy is immeasurable.

This piece not only holds significant historical importance but also reflects the investment potential similar to high-end collectibles in the market today.

Share

Join Our History Vault!

Be the first to discover rare artifacts, exclusive deals, and stories behind history’s greatest treasures.